Understanding and Setting Financial Goal

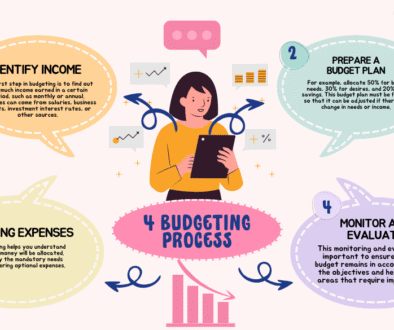

1. Access Your Financial Situation (Money Situation)

Everyone knows how much they earn, but majority they lost track of where their money goes. However, ensuring we track and set efficiency goal, we need to access current situation of our money. Here the key points:

- Income: how much you earn, and which income sources such salary, or business profits?

- Expense: how much you spend? Do you spend over your earning income?

- Saving & Investment: do you allocate some money you earn saving or for any investment such fixed deposit or buy any small stock ($10 per month)?

- Debts & Loan: access how much is your debts, is your repayment or installment amount impact to your expense or income. Talk to lenders if there is any difficulty for repayment for solutions.

- Financial Goal: Do you have specific goal such have amount of money you wish to have in the next 5 year for starting a small business, buying a house, travel to anywhere after graduation?

Recommendation: check your pocket, your bank account balance by end of every month if there is any money left.

- Yes = $Balance is reaming 10 or 20% of total monthly income; Your financial heal is good.

- No = $balance is ZERO; Your financial health is at Risk or leading to debts. Please read financial discipline and improve your money behaviors.

2. Define Clear Financial Goals

At this section, SMART GOAL is recommended for young generation like you. This smart goal shall be defined for income, expense, saving or investment, or building wealth.

SMART GOAL; below is the briefly explain about SMART GOAL:

- Specific: Clearly define; (e.g., save $5,00 for an emergency fund)

- Measurable: Track progress with your saving (e.g., save $50 per month).

- Achievable: Ensure the goal is realistic to income and expenses.

- Relevant: The goal should align with your income or realistic or situation.

- Time-Bound: Set a clear deadline (e.g., achieve this goal within 10 months)

This goal shall be set in following by using SMART GOAL approach:

2.1 Income: how much you shall earn in the future & diversify your income goal sources;

2.2 Expense: define clearly all your expenses, how much you will expense in every month.

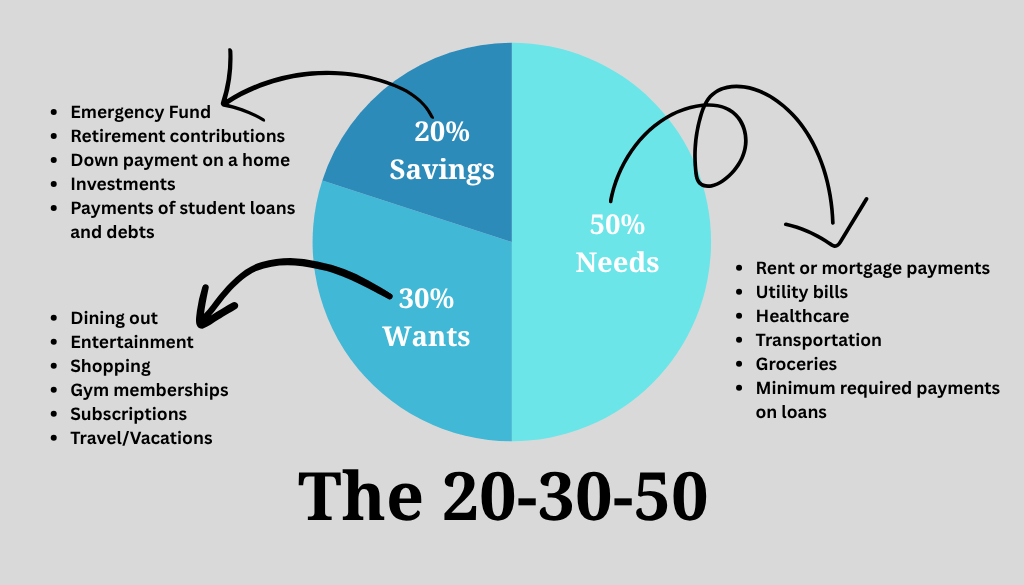

2.3 Saving & investment: setting 10% for saving and 10% for investment from your monthly income. (at least take 20% of total income for saving & investment), I believe saving is hard, at you try it whether small fraction of your money.

2.4 Debts: reduce your current debts and consider carefully if you want to loan goal, if the productive loan.

2.5 Building Wealth: make your goal and write it down on the paper or record in any tool at your convincing; such as buy a property, own a house in specific amount and timeline.

Figure 2; This graph below will help you to visualize your money vision. You need to reflex and define realistic goal relevant to your situation.