Introduction to Financial Literacy

1. Welcome Your Readers!

Starting to read and understand FINANCIAL LITERACY, and knowledge of personal finance, you take a crucial step in your life toward building a better, smarter, and secure way for the future.

We all need money in every part of our lives, money for food, chasing our dreams, taking care of our health, improving our lifestyle, and many other things we can’t describe.

When you understand money, you will have the power to control your life and live a secure way.

It doesn’t matter where you are starting from — what matters is that you are starting.

Step by step, you’ll discover that financial success is not just for the lucky — it’s for the prepared.

2. What is financial literacy?

Financial Literacy is essential financial knowledge and the ability to understand and use personal finance (money & investment) wisely and efficiently including; preparing your budgeting, saving, investing, and handling debts. The following key aspects for financial literacy that we designed structures for individuals are following:

- Understanding Key Financial Concepts

- Essential financial skills for the young generation

- Practical Application of Financial Literacy

- Protecting Common Financial Fraud & Risk

- Common Financial Mistakes

3. Why is financial literacy important?

“Without financial literacy, our life likely faces lifetime debts. Young adults need to have financial goals and prepare accordingly.”

Without financial literacy, young adults are likely to face serious challenges in the future, such as struggling with debts from friends, or lending entities, struggling with earning paycheck to paycheck with no savings, lead financial pressure or stress, and limited financial freedom. In Cambodia, financial literacy or personal finance education still has gaps in awareness, and equipping youth with the tools needed for using money wisely and efficiently is essential for financial growth and sustainability. These are the following reasons that Financial Literacy (PERSONAL FINANCE) matters to your life:

- Manage Money Wisely and Effectively

- Prepare for your financial stability & security

- Empower individuals for well-being and economic opportunity

- Prevent financial fraud and risk

- Support Cambodia’s economic growth

4. Core Principles of Finance

The principle of Finance is key to discipline your way of managing your money wisely in how you will save or spend from your income. Based on experience and mistakes, everyone creates their own rules to ensure they adopt the discipline to overcome their mistakes. These simple principles shall be great input for assisting you to discipline yourself.

=> Principle 1: Never Spend More Than You Earn

This is a golden rule of managing your money whether your personal finance or business finance. Spend less than you earn, you will leave more cash in your pocket rather than living a broke life.

-

- Why: Spending more than you earn leads you to debt.

- Solution: prepare your budget and plan your expenses wisely. (Budgeting & Financial Plan)

=> Principle 2: Create Your Budgeting Plan

Budgeting is an approach for you to manage your finances from your income, and how you allocate your expenses, saving and investing to meet your short-term or long-term goal or simple way called a “money plan”. This will help you to control the money instead of letting money control you.

-

- Why: this help to track and know where your money goes.

- Solution: Plan (write down all income, expense or saving every month), compare your actual actives with your plan.

=> Principle 3: Save 20% of Your Earning

Always keep 20% of every income you earn as your saving, this habit builds financial security. Make it until become a habit of 20% saving.

-

- Why: emergencies need (ex. health issue) and future need (ex. invest for your Master or PhD degree or create a small family).

- Solution: Save at 20% of income in separately approach based on your goal; fixed saving, mobile wallet, or pinky saving.

=> Principle 4: Avoid Bad Debts

Borrowing money correctly will increase your money value or help you to earn more money in the future called “Productive Debts”. Calculate and think twice before taking any loan or debts ensuring align with your purpose and ability to pay back. Avoiding high interest rate or informal lending.

-

- Why: High-Interest Loan or bad debt lead you into money stress and lifetime responsibility by living paycheck to paycheck.

- Solution: borrower for productive and value purpose such for education, business purpose. Understanding your ability and make sure installment amount (repayment) shall at least not exceed 30% of your income.

=> Principle 5: Know Your Finance Situation

Understanding financial position, where you stand compared to your plan or any loan and money have, help you with good decision in term of how you will allocate your income and make yourself more discipline.

-

- Why: it will help you to know your Net Worth (Net worth = total asset – liabilities), value of asset and diversify your money to grow more.

- Solution: list or write down all value of asset, liabilities and equities you have such property, savings and any loan you have.

=> Principle 6: Plan Long-Term

Setting long-term financial plan 5 to 10 years and start to act based on your plan. The goal is for saving for your retirement, buy a house for yourself or any business plan after you graduate from college and you start with your saving amount.

-

- Why: You have clearly direction in term of financial rather than you just live without purpose lead you to insecure financial.

- Solution: Write down your long-term goal and amount of money you need to achieve long term goal. Example; Goal: Own a house in next 8-Years, amount: $40,000.

=> Principle 7: Keep Learning

Keep learning

about financial will help you build knowledge and empower to yourself grow from day-to-day by staying informed to avoid on any money mistake and trap and take any economic opportunity from this opening world.

-

- Why: Avoid bad money habit, scamming, fraud and taking any economic opportunity to grow.

- Solution: build your financial literacy, financial inclusion or personal finance, attend workshop related to financial literacy, life and money, join any relevant classes.

5. Money Rule

One the simple rule that you must train your money psychology;

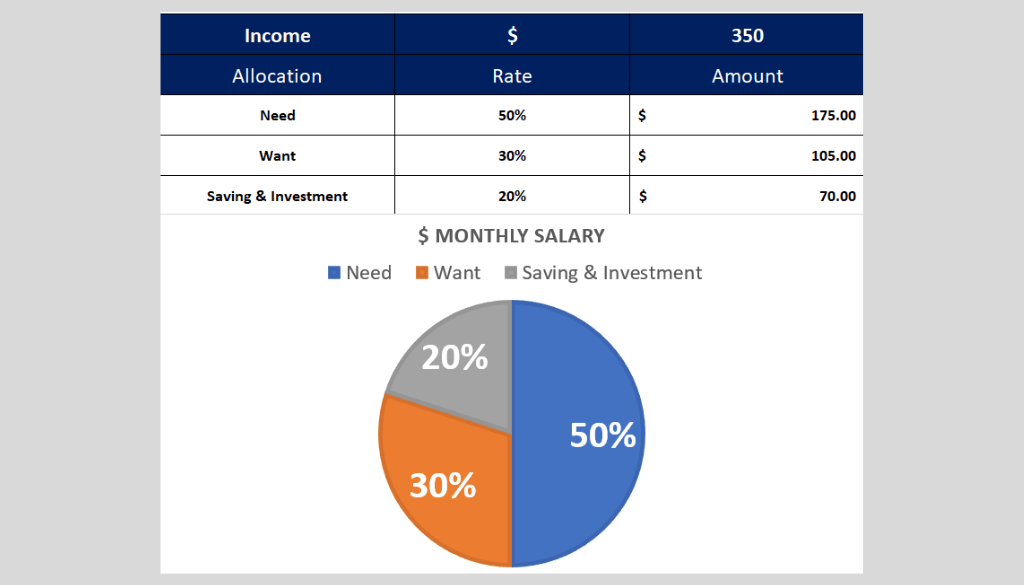

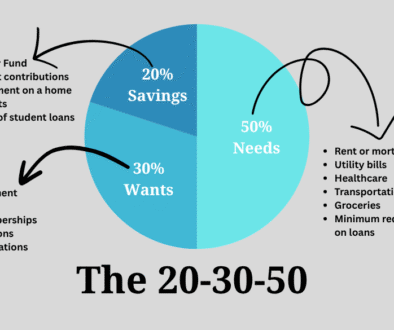

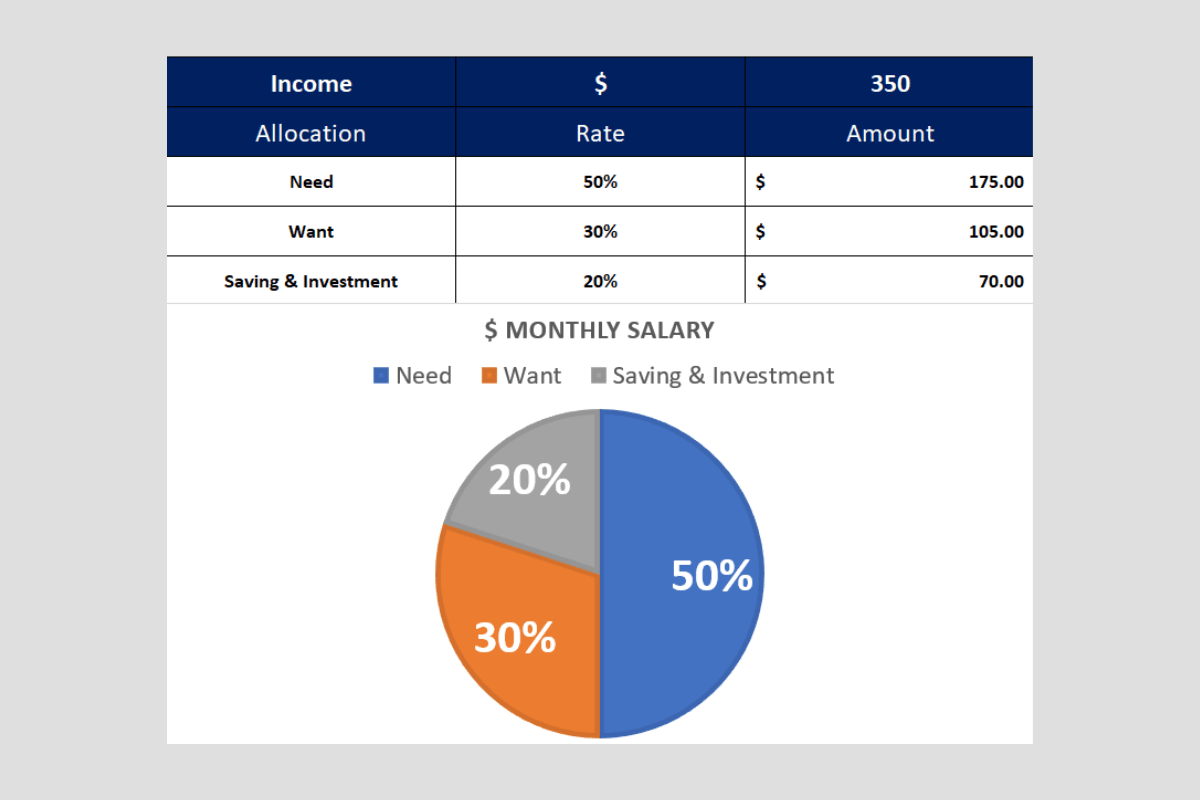

Rule 50/30/20; it is one of the rule or method you can use to suggest your dividing income into difference categories.

- Needs (50% of income allocate for needs) : This 50% of income amount will be for essential expense like rent, mortgage, utilities, transportation, and other items require or must be paid.

- Wants (30% of income allocate for wants) : Allocate 30% of your income for some expense that you wish to buy, but not very priority or must be.

- Saving and Investment (20% of income allocate for saving & investment) :

20% amount of your earning income allocate for saving account, build emergency fund, paid off bad debts loan or invest in stock/cryptocurrency, etc.

Figure 1; Sample of allocation money based on the rule;

Remember:

Flexible based on your actual and adjust accordingly, especially unnecessary expense, if you can save or didn’t spend at all and keep as saving or put into investment item. By using this method, you are building good of financial health & financial awareness, your future financial will lower risk and you become aware of where your money is going and can make adjustment based on actual needed.